For Romanian PFA and SRL

The Best Tax Calculation System

Taxwise is the ultimate tax companion for SMEs in Romania, making it effortless to compliance. Whether you're a PFA or an SRL, Taxwise handles thresholds, CAS/CASS, VAT, and deductions with precision—so you can focus on growing your business, not decoding tax forms.

Export your tax reports to pdf or XML in a click

"Everything you need to calculate your taxes and stay compliant with ANAF"

Othman Sultan

Sunnah Invest SRLWe used to dread tax season, but Taxwise completely changed that.

With built-in logic for dividends, microcompany thresholds, and real-time alerts, we've reduced our accountant reliance by 90%. It's like having a financial analyst in your dashboard.

Randy

Founder & CEO, Gymscanner SRLTaxwise handles everything — CASS, CAS, VAT, real income vs lump sum — so we don't have to.

Filing used to be a mess with spreadsheets and consultants. Now we file directly through the dashboard with confidence. It saves us time, money, and legal headaches.

Ana M.

Freelancer (PFA), Cluj-NapocaTaxwise is the smartest tool I've used since becoming a PFA. It calculates everything perfectly — even alerts me when I'm close to the VAT threshold.

I no longer need to hire an accountant just to file. The savings are real.

Styled for your brand

Responsive

Responsive, and mobile-first project on the web

Learn moreResponsive

Responsive, and mobile-first project on the web

Learn moreResponsive

Responsive, and mobile-first project on the web

Learn moreResponsive

Responsive, and mobile-first project on the web

Learn moreResponsive

Responsive, and mobile-first project on the web

Learn moreResponsive

Responsive, and mobile-first project on the web

Learn moreResponsive

Responsive, and mobile-first project on the web

Learn moreResponsive

Responsive, and mobile-first project on the web

Learn moreGet Wise with your Taxes

Perfect for PFA and SRL to automate tax calculations

Payments

Connect to Stripe and start accepting payments in minutes with a beautifully optimized checkout experience.

- Tax Due

- CAS (if in threshold)

- CASS

- VAT Handling

Alerts & Deadlines

Never miss another tax filing deadline with our custom deadline reminders sent your email and phone.

- Tax Filing due In 30 Days

- Send E-Factura to ANAF Within 4 days

- File Refund Receipt 3 Days Left

E-Factura

Create and send ANAF compliant e-factura to your customers with a few clicks.Efactura is integrated in Taxwise at no additional cost.

Help Desk

Our dashboard is so simple, smooth and fun to use that you will never need any help. But our tax experts are always ready to help in live chat.

(we will need a chat conversation)

I need help integrating with my webflow site

I need help integrating with my webflow site

I need help integrating with my webflow site

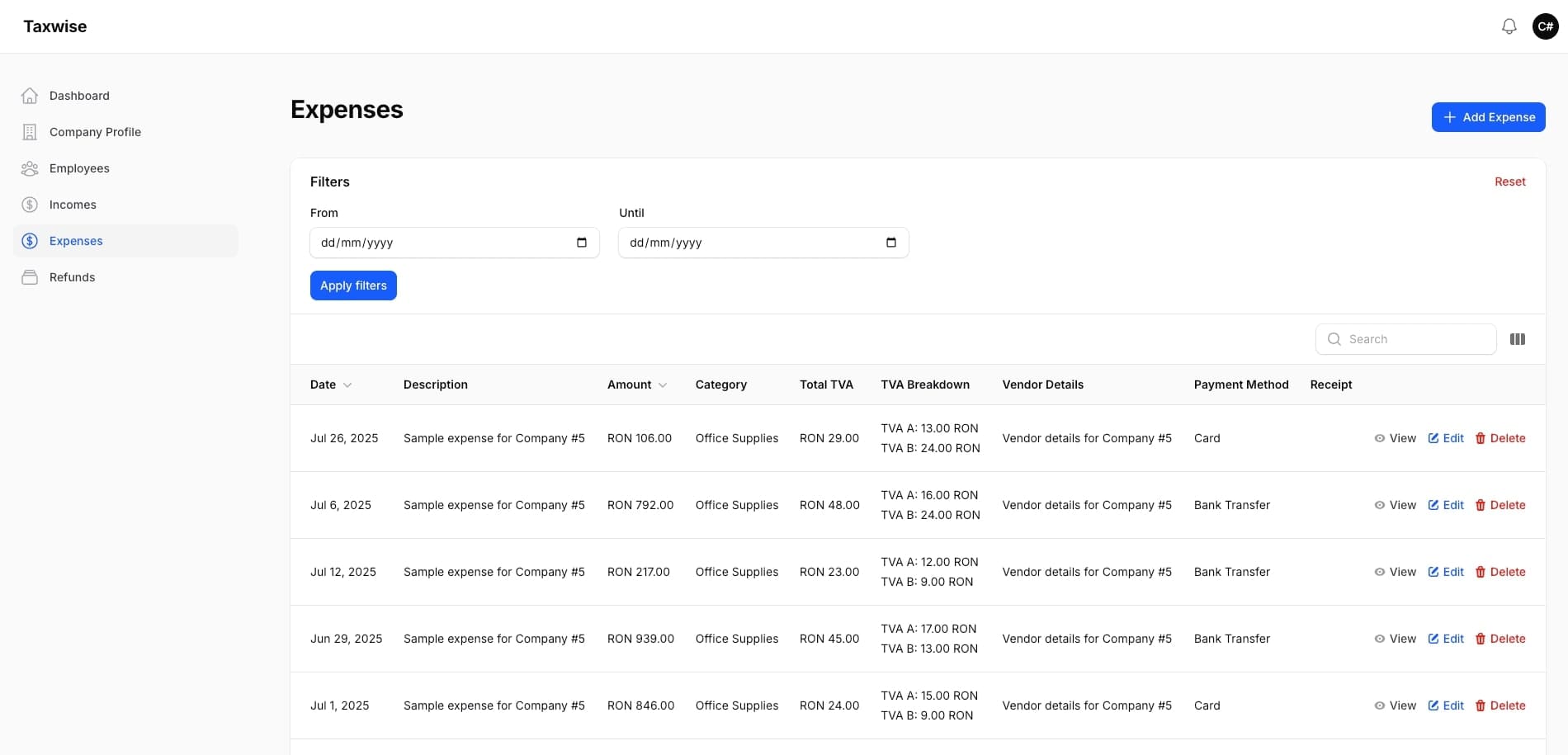

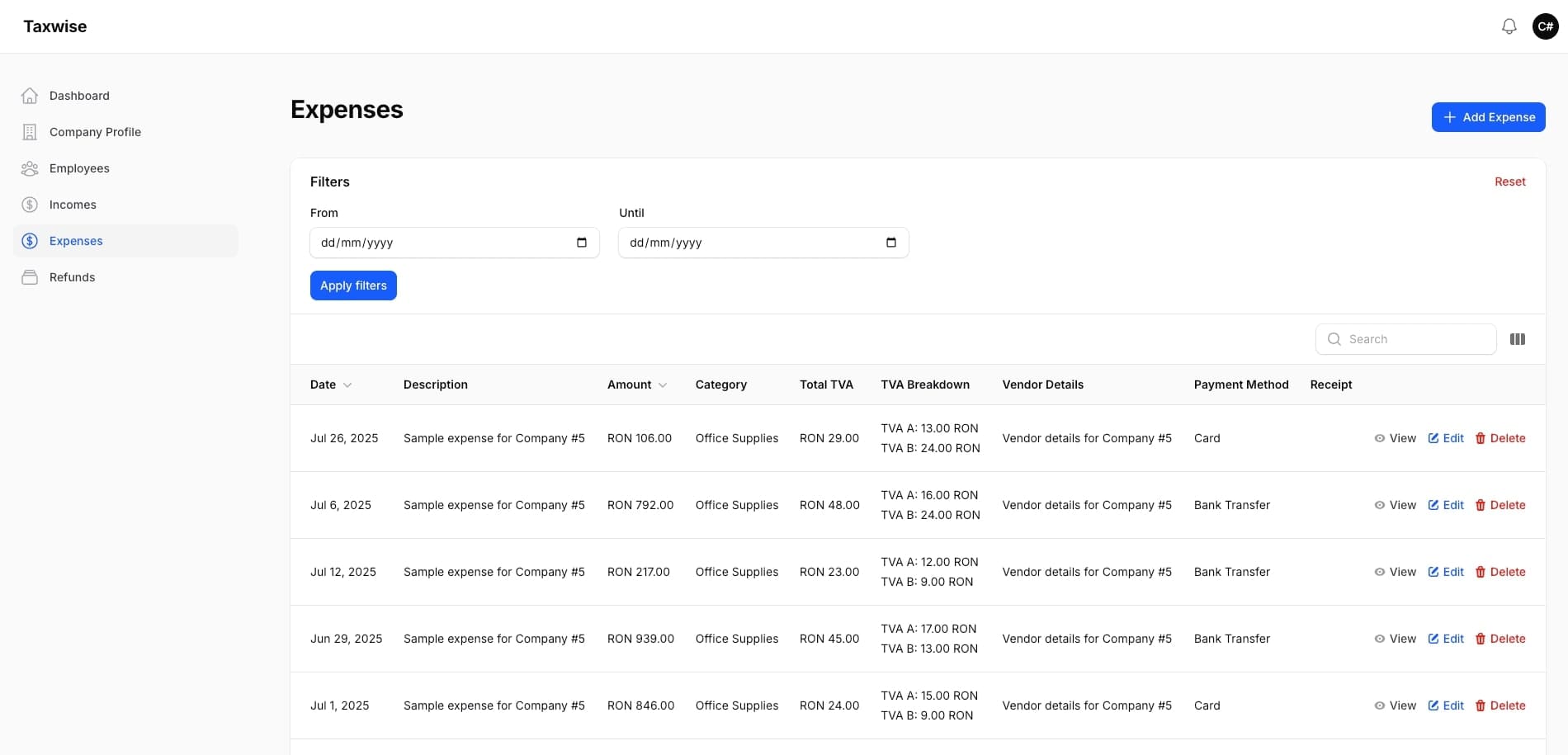

Super Secure

Taxwise uses industry leading authentication and security to protect your data and only you can allow who to give access to.

Custom Reports

View custom reports of your taxes, invoices, VAT and everything about your company in real time.

Switch to Taxwise

Taxwise gives you instant calculations, real-time compliance alerts, and everything you need to file confidently — without paying a monthly accountant.

Before

- Paying 600-1000 RON/month to an accountant

- Unclear if you're overpaying or underreporting

- You depend on someone else for every tax move

- Manually checking thresholds for CAS, CASS, VAT, dividend tax

- Struggling to prepare Form 212, 100, 300, 394

- No visibility into pension & health contribution logic

- Still faxing or emailing invoices to your accountant

- Endless email threads and WhatsApp messages

After

- One low annual price, no hidden fees

- Transparent calculations based on up-to-date thresholds

- You control every step, anytime

- Automated alerts when you're about to cross legal limits

- Smart auto-fill for ANAF forms

- Detailed breakdowns of all CAS & CASS tiers

- Generate ANAF-ready e-invoices in a click

- All documents and calculations in one clean dashboard

Get Started with Taxwise Today?

ANAF compliance has never been so easy or affordable before. Start your 30 day trial today.

Start Your Free Trial